How much does a standard industrial cable cost per meter?

The cost of a standard industrial cable per meter can vary widely, typically ranging from as low as \(0.10 per meter for very basic types to over \)100 per meter for specialized, high – end industrial cables. Here are the key factors that contribute to this price variation:

1. Material used

Conductor material

- Copper: Copper is a highly conductive material and is widely used in industrial cables. High – purity copper cables tend to be more expensive. For example, a basic copper – conductor industrial cable with a small cross – sectional area (e.g., 1 – 2 square millimeters) might cost around \(1 – \)3 per meter. However, as the cross – sectional area increases to accommodate higher current loads (e.g., 50 – 100 square millimeters), the price can rise to \(20 – \)50 per meter. This is because more copper material is required, and larger – gauge copper conductors are more difficult to manufacture.

- Aluminum: Aluminum is a more cost – effective alternative to copper. It has a lower conductivity but is lighter in weight. Aluminum – conductor industrial cables can be 30 – 50% cheaper than their copper counterparts. A basic aluminum – conductor cable in the same small cross – sectional area range (1 – 2 square millimeters) may cost \(0.50 – \)1.50 per meter. But similar to copper cables, as the cross – sectional area increases, the price goes up, though still at a lower rate compared to copper. For large – area aluminum cables (50 – 100 square millimeters), the cost might be \(10 – \)20 per meter.

Insulation and sheath materials

- PVC (Polyvinyl Chloride): PVC is a common and relatively inexpensive insulation and sheath material. Cables with PVC insulation and sheath are suitable for many general – purpose industrial applications. A PVC – insulated and sheathed industrial cable could cost anywhere from \(0.20 – \)5 per meter, depending on the conductor type and size.

- XLPE (Cross – Linked Polyethylene): XLPE offers better electrical and mechanical properties compared to PVC, such as higher temperature resistance and longer lifespan. As a result, XLPE – insulated industrial cables are more expensive. They can range from \(1 – \)10 per meter, again depending on other factors like conductor material and size.

- Rubber: Rubber – insulated cables are often used in applications where flexibility and durability are crucial, such as in mobile machinery. Rubber – based industrial cables can be relatively costly, with prices starting at around \(2 per meter and going up to \)20 or more per meter for high – performance rubber – insulated cables.

2. Cable size and specifications

Cross – sectional area

The cross – sectional area of the conductor in an industrial cable is a major determinant of its cost. Larger cross – sectional areas are needed to carry higher electrical currents. As mentioned earlier, increasing the cross – sectional area requires more conductor material, which drives up the price. For instance, a 1 – square – millimeter cable will be significantly cheaper than a 50 – square – millimeter cable of the same type.

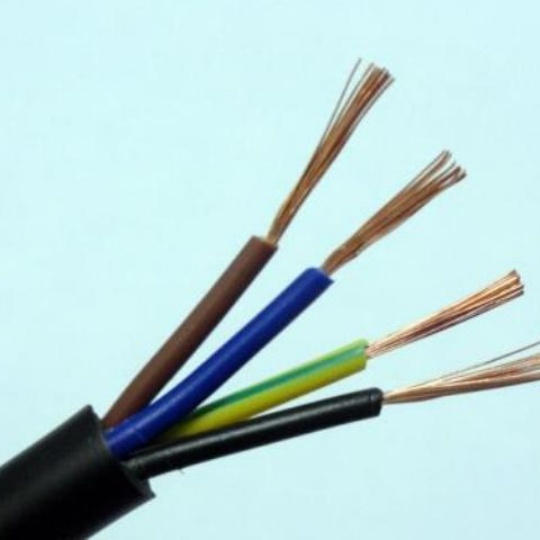

Number of cores

Multi – core industrial cables are used in various applications, such as power distribution and control systems. The more cores a cable has, the higher its cost. A two – core cable will generally be cheaper than a four – or six – core cable of the same conductor size and material. For example, a two – core copper – conductor PVC – insulated cable might cost \(2 – \)5 per meter, while a four – core cable with the same basic characteristics could cost \(3 – \)8 per meter.

Voltage rating

Cables with higher voltage ratings need to meet more stringent safety and performance requirements. They often require thicker insulation and better – quality materials. A low – voltage (e.g., 240V) industrial cable may cost \(0.50 – \)3 per meter, while a high – voltage (e.g., 11kV or 33kV) cable can cost \(10 – \)100 per meter or more.

3. Special features and applications

Flame – retardant and fire – resistant cables

These cables are designed to prevent the spread of fire or maintain their functionality during a fire. They use special materials and manufacturing processes, which make them more expensive. Flame – retardant cables can cost 20 – 50% more than regular cables, while fire – resistant cables can be 50 – 100% more costly. For example, a regular PVC – insulated cable might cost \(2 per meter, while a flame – retardant version of the same cable could cost \)2.40 – \(3 per meter, and a fire – resistant version could be \)3 – $4 per meter.

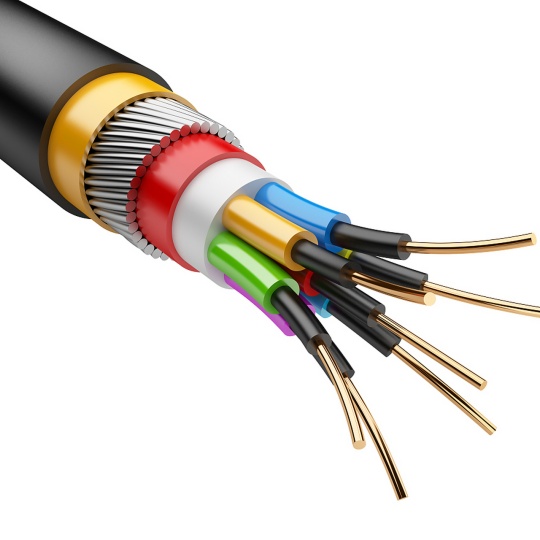

Shielded cables

Shielded industrial cables are used in applications where electromagnetic interference (EMI) or radio – frequency interference (RFI) needs to be blocked. The shielding layer, usually made of materials like aluminum foil or braided copper, adds to the cost. Shielded cables can be 30 – 80% more expensive than unshielded cables. A non – shielded control cable might cost \(1 per meter, while a shielded version of the same cable could cost \)1.30 – $1.80 per meter.

Cables for harsh environments

Cables designed for use in harsh environments, such as those resistant to water, oil, chemicals, or extreme temperatures, require specialized materials. For example, cables for underwater applications need to be waterproof and corrosion – resistant. These cables can be 50 – 200% more expensive than standard cables. A standard industrial cable for general indoor use might cost \(1 per meter, while a cable suitable for use in a chemical – plant environment could cost \)1.50 – $3 per meter.

4. Market and production factors

Brand and reputation

Well – known and reputable cable manufacturers often charge a premium for their products. Their cables are likely to meet higher quality standards, have better performance, and come with reliable warranties. A cable from a leading brand might cost 10 – 50% more than a cable from an unknown or less – established manufacturer. For example, a cable from a top – tier brand that costs \(3 per meter might have a similar – spec cable from a lesser – known brand available for \)2 – $2.70 per meter.

Production volume

Economies of scale play a role in cable pricing. Manufacturers can offer lower per – meter prices when producing large quantities. If you are purchasing a small amount of cable (e.g., a few hundred meters), the price per meter will be higher compared to buying a large roll of several thousand meters. For instance, buying 100 meters of a particular cable might cost \(3 per meter, but if you buy 10,000 meters, the price per meter could drop to \)2.50.

Market demand and supply

When the demand for industrial cables is high, such as during a construction boom or a period of increased industrial expansion, prices tend to rise. Conversely, if there is an oversupply in the market, prices may decrease. For example, in a region with a lot of new factory construction projects, the price of industrial power cables might increase by 10 – 20% due to high demand.

To get an accurate cost for the industrial cable you need, it’s best to request quotes from multiple suppliers. Provide them with detailed information about the cable specifications, including the conductor material, insulation type, cross – sectional area, number of cores, voltage rating, and any special features required. This will ensure you get a price that reflects your exact needs.